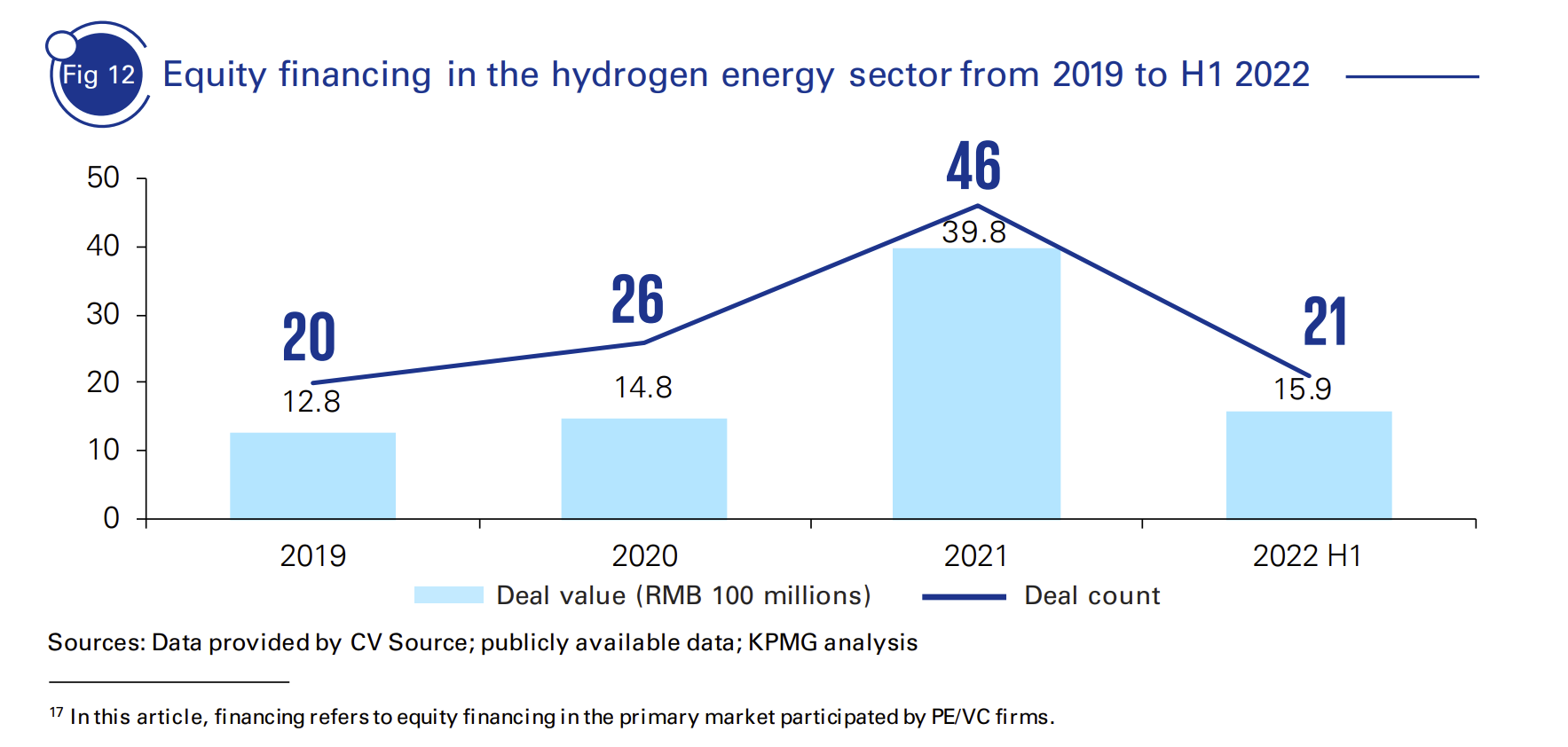

In H1 2022, the hydrogen energy sector saw robust equity financing activity, continuing the trend seen in the previous year. In China, hydrogen energy companies raised RMB 1.59 billion in 21 deals, which represented an increase in deal value and deal count of 137% and 50% year-on-year, respectively (see Figure 12). 17

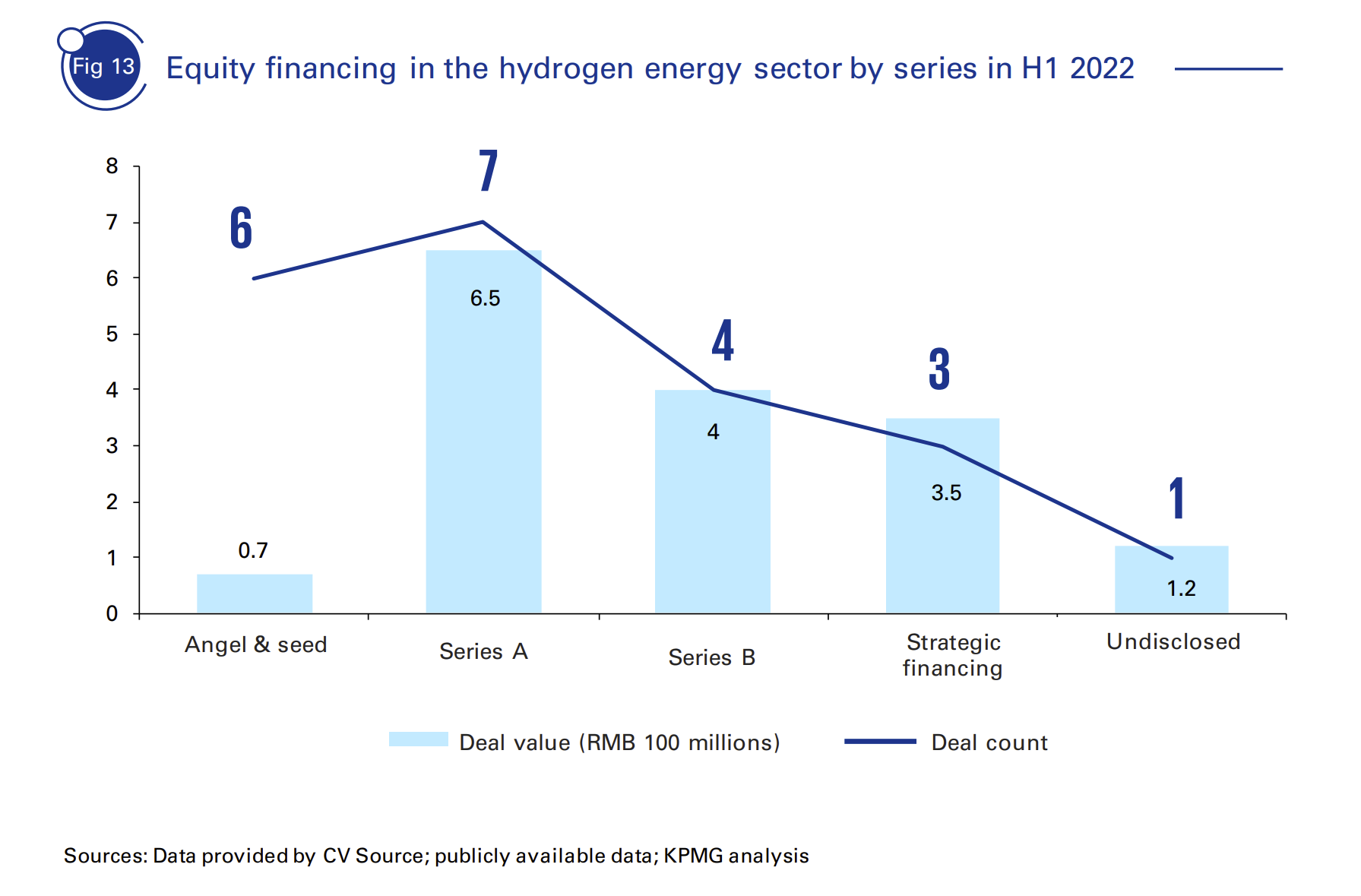

In terms of deal share by financing series, given that China’s hydrogen energy industry is still in its infancy, financing mainly occurred at early rounds. In H1 2022, series A deals ranked first in both deal value and count. During this period, hydrogen energy companies raised RMB 650 million in 7 series A deals, RMB 400 million in 4 series B deals, RMB 350 million in 3 strategic financing deals, and RMB 70 million in 6 angel & seed deals (see Figure 13).

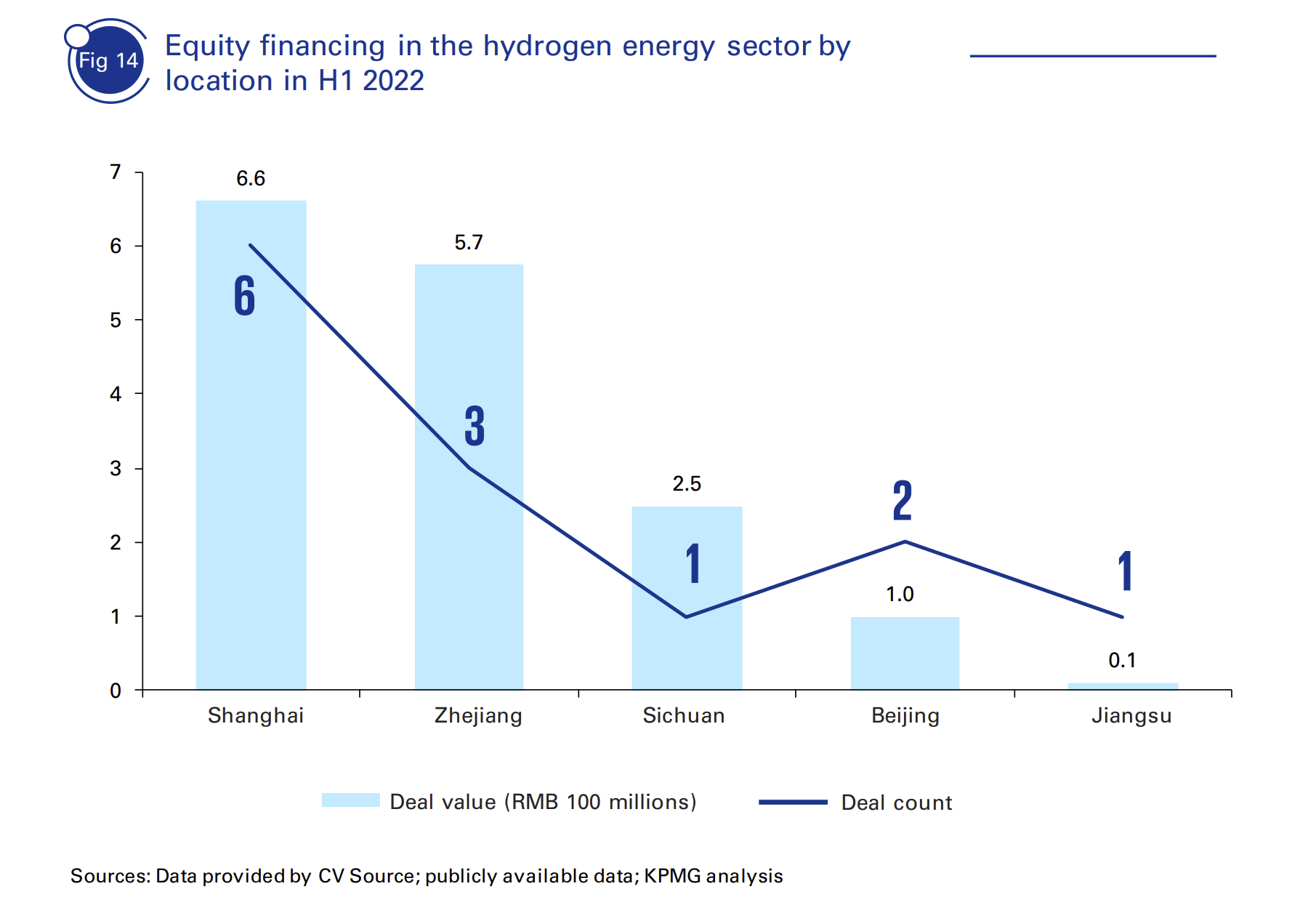

In terms of deal share by location, Shanghai, Zhejiang, Sichuan, and Beijing outperformed other areas. In recent years, these regions have taken advantage of their own resources to introduce local hydrogen plans, and they have carried out pilot programs to promote the industrialization of hydrogen and fuel cell technology. In particular, Shanghai and Jiangsu have been among the first in China to research, develop and demonstrate FCEVs. In addition, Sichuan is one of the major domestic bases for producing hydrogen from renewable energy and researching and developing stacks for core fuel cell components. Furthermore, Beijing was among the first cities or regions to research and develop fuel cell stacks and their key components. Industrial clusters in these regions have grown over the years and begun to deliver a real impact. In H1 2022, hydrogen energy companies raised RMB 660 million in Shanghai, RMB 570 million in Zhejiang, RMB 250 million in Sichuan, and RMB 100 million in Beijing, altogether accounting for 99% of the total deal value for the period. In terms of deal count, Shanghai led with 6 deals, followed by Zhejiang and Beijing with 3 and 2, respectively, in H1 2022 (see Figure 14).

The article originates from Sources: Statista; KPMG analysis